Statement outlining results, risks and significant changes in operations, personnel and program for the quarter ended December 31, 2012

1. Introduction

This quarterly report has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. This quarterly report should be read in conjunction with the Main Estimates and Supplementary Estimates as well as Canada's Economic Action Plan 2012 (Budget 2012).

The Veterans Review and Appeal Board (VRAB) is an independent, quasi-judicial tribunal that fulfills an important role within Canada's disability benefits system for Veterans, Canadian Forces members, Royal Canadian Mounted Police members and their families. Throughout the year, in locations across the country, members hear and make decisions on applications for review and appeal of disability decisions rendered by Veterans Affairs Canada. As Canadians, they carry out this work with a strong sense of the responsibility inherent in the Board's mandate to those who have served – and continue to serve – their country. As adjudicators, they are often faced with difficult human situations and complex issues in making decisions.

The role of the Board is to determine whether the laws governing the disability benefits programs for Veterans and other applicants have been properly applied by Veterans Affairs Canada in individual cases. To accomplish this, they conduct hearings where they listen to applicants' testimony and/or arguments from representatives and consider new evidence; interpret and apply the legislation based on the evidence; and render written decisions with reasons for their rulings. In making these decisions, Board members are required by law to resolve any doubt in favour of applicants. While the Board is not able to rule favourably in all cases, it makes every effort to issue a fair and well-reasoned decision for each applicant. The Board's objective is to ensure that Canada's traditional Veterans, Canadian Forces members and Veterans, Royal Canadian Mounted Police members, qualified civilians and their families receive the disability pensions, disability awards and other benefits to which they are entitled under the law.

A summary description of the Veterans Review and Appeal Board program activities can be found in "Part II of the Main Estimates".

Basis of Presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes VRAB's spending authorities granted by Parliament and those used by the Board, consistent with the Main Estimates for the 2012-13 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before monies can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

As part of the departmental performance reporting process, the VRAB prepares its annual departmental financial statements on a full accrual basis in accordance with Treasury Board accounting policies, which are based on Canadian generally accepted accounting principles for the public sector. However, the spending authorities voted by Parliament remain on an expenditure basis.

As part of the Parliamentary business of supply, the Main Estimates must be tabled in Parliament on or before March 1 preceding the new fiscal year. Budget 2012 was tabled in Parliament on March 29, after the tabling of the Main Estimates on February 28, 2012. As a result the measures announced in the Budget 2012 could not be reflected in the 2012-13 Main Estimates.

In fiscal year 2012-2013, frozen allotments will be established by Treasury Board authority in departmental votes to prohibit the spending of funds already identified as savings measures in Budget 2012. In future years, the changes to departmental authorities will be implemented through the Annual Reference Level Update, as approved by Treasury Board, and reflected in the subsequent Main Estimates tabled in Parliament.

The quarterly report has not been subject to an external audit or review.

2. Highlights of Fiscal Quarter and Fiscal Year-to-Date (YTD) Results

Statement of Authorities

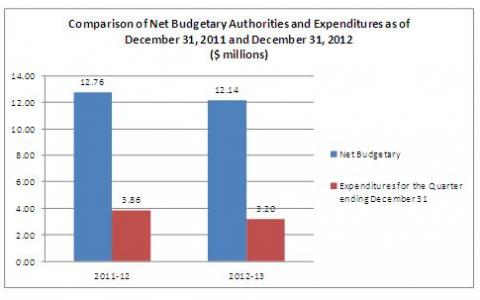

As at December 31, 2012, the Board's total authorities available for use have decreased by $618 thousand, a decrease of 5.0% when compared to the end of the same quarter of 2011-12. Actual YTD expenditures at the end of the third quarter showed a decrease from $3.86 million in 2011-12 to $3.20 million in 2012-13. These decreases are mainly due to additional expenditures on personnel incurred in 2011-2012 as a result of the requirement to make payments in lieu of severance and termination benefits due to the revision of specific collective agreements.

Figure 1 - Third Quarter Expenditures Compared to Annual Authorities

Comparison of Net Budgetary Authorities and Expenditures as of September 30, 2011 and September 30, 2012

Text Version

This image consists of a bar chart with the y axis broken down into two million dollar increments, the y axis indicating two fiscal years, 2011-12 and 2012-13, a blue rectangular bar representing net budgetary authority and the red rectangular bar representing expenditures for the quarter ending September 30th. The chart shows that VRAB's budget was 11.54 million in 2011-12 and is 11.5 million in 2012-13 and that the expenditures for the quarter ending September 30 were 2.88 million in 2011-12 and 2.69 million in 2012-13.

Statement of Departmental Budgetary Expenditures by Standard Object

In general, VRAB's expenditures are distributed equally throughout the year. This trend is consistent in this fiscal year, given that expenditures at the end of the third quarter are equivalent to 71% of authorities available for use.

Most standard object category expenditures are consistent with prior year spending trends.

3. Risks and Uncertainties

The Veterans Review and Appeal Board is funded through annual appropriations. As a result, its operations are impacted by any changes in funding approved through Parliament. There is a risk that VRAB's capacity to address emerging financial pressures will decrease, as a result of Budget 2010 or other centrally-imposed cost containment measures which require government departments and agencies to manage increased spending within existing reference levels.

Context: VRAB is the independent appeal tribunal for the disability pension and disability award programs administered by Veterans Affairs Canada (VAC). The Board was created by Parliament in 1995 to provide Veterans and other applicants with an independent avenue of appeal for disability decisions made by VAC, the Department. Applicants who are dissatisfied with their departmental decision have two levels of redress before VRAB: review and appeal. The Board also hears final appeals of War Veterans Allowance applications. As a service-oriented agency, the majority of VRAB's operating expenditures are salary based and demand-driven. Managing the demand for hearings is driven by a variety of factors over which VRAB has limited influence, including; societal trends where there is increased reliance on the Board to hear appeals. Overall, increasing litigation and the requirement for legal advice on complex issues is placing pressure on the Board's legal services and its ability to manage the demand.

As a means of managing this risk, VRAB monitors and adjusts its workload accordingly to avoid sudden unexpected increases or drops in demand. As required, departing Governor in Council appointees or departing staff members are replaced to ensure adequate human resources support to the redress process. The Board has also developed succession plans and extensive training programs to prepare its staff for the future. In addition, VRAB has a multi-year plan to proactively prioritize spending initiatives and address emerging pressure. Authorities and expenditures are monitored regularly through progress reports and with the engagement of senior management.

4. Significant changes in relation to operations, personnel and programs

There have been no significant changes in relation to operations, personnel and programs over the last year.

5. Budget 2012 Implementation

Veterans Review and Appeal Board was not identified for savings in Budget 2012.

Approved by:

John D. Larlee, Chair

Veterans Review and Appeal Board

Charlottetown, PE

Charlotte Stewart, A/Chief Financial Officer

Veterans Affairs Canada

Charlottetown, PE

Statement of Authorities (unaudited)

Quarterly Financial Report for the quarter ended December 31, 2011

| (in thousands of dollars) | Total available for use for the year ending March 31, 2012* | Used during the quarter ended December 31, 2011 | Year to date used at quarter-end |

|---|---|---|---|

| Vote 10 - Veterans Review and Appeal Board Operating expenditures | 11,152 | 3,458 | 8,154 |

| Budgetary statutory authorities | 1,604 | 401 | 1,203 |

| Total Budgetary authorities | 12,756 | 3,859 | 9,357 |

| Non-budgetary authorities | |||

| Total Authorities | 12,756 | 3,859 | 9,357 |

* Includes only Authorities available for use and granted by Parliament at quarter-end.

Quarterly Financial Report for the quarter ended December 31, 2012

| (in thousands of dollars) | Total available for use for the year ending March 31, 2013* | Used during the quarter ended December 31, 2012 | Year to date used at quarter-end |

|---|---|---|---|

| Vote 10 - Veterans Review and Appeal Board Operating expenditures | 10,569 | 2,811 | 7,402 |

| Budgetary statutory authorities | 1,569 | 392 | 1176 |

| Total Budgetary authorities | 12,138 | 3,203 | 8,578 |

| Non-budgetary authorities | |||

| Total Authorities | 12,138 | 3,203 | 8,578 |

* Includes only Authorities available for use and granted by Parliament at quarter-end.

Departmental budgetary expenditures by Standard Object (unaudited)

Quarterly Financial Report for the quarter ended December 31, 2011

| Expenditures (in thousands of dollars) |

Total available for use for the year ending March 31, 2012 | Used during the quarter ended December 31, 2011 | Year to date used at quarter-end |

|---|---|---|---|

| 01 Personnel | 11,511 | 3,426 | 8,319 |

| 02 Transportation and communications | 750 | 241 | 658 |

| 03 Information | 6 | 1 | 1 |

| 04 Professional and special services | 300 | 109 | 239 |

| 05 Rentals | 25 | 11 | 25 |

| 06 Repair and maintenance | 43 | 31 | 32 |

| 07 Utilities, materials and supplies | 101 | 31 | 70 |

| 08 Acquisition of land, buildings and works | - | - | - |

| 09 Acquisition of machinery and equipment | 20 | 9 | 13 |

| 10 Transfer payments | - | - | - |

| 11 Public debt charges | - | - | - |

| 12 Other subsidies and payments | - | - | - |

| Total gross budgetary expenditures | 12,756 | 3,859 | 9,357 |

| Less Revenues netted against expenditures: | |||

| Total Revenues netted against expenditures: | - | - | - |

| Total net budgetary expenditures | 12,756 | 3,859 | 9,357 |

Quarterly Financial Report for the quarter ended December 31, 2012

| Expenditures (in thousands of dollars) |

Total availalbe for use for the year ending March 31, 2013 | Used during the quarter ended December 31, 2012 | Year to date used at quarter-end |

|---|---|---|---|

| 01 Personnel | 10,349 | 2,838 | 7,659 |

| 02 Transportation and communications | 954 | 253 | 600 |

| 03 Information | 4 | - | - |

| 04 Professional and special services | 663 | 75 | 201 |

| 05 Rentals | 25 | 8 | 16 |

| 06 Repair and maintenance | 38 | 1 | 33 |

| 07 Utilities, materials and supplies | 90 | 17 | 55 |

| 08 Acquisition of land, buildings and works | - | - | - |

| 09 Acquisition of machinery and equipment | 15 | 11 | 14 |

| 10 Transfer payments | - | - | - |

| 11 Public debt charges | - | - | - |

| 12 Other subsidies and payments | - | - | - |

| Total gross budgetary expenditures | 12,138 | 3,203 | 8,578 |

| Less Revenues netted against expenditures: | |||

| Total Revenues netted against expenditures: | - | - | - |

| Total net budgetary expenditures | 12,138 | 3,203 | 8,578 |